Augusta Precious Metals Review

Table of Contents

- Introduction

- Company Background

- Augusta Silver IRA

- IRA Custodians

- Gold and Silver Cash Purchases

- Augusta Gold and Silver Setup and Pricing

- How to invest with Augusta Precious Metals?

- Support

- Conclusion

Introduction

Augusta Precious Metals is a trusted provider of gold and silver IRA solutions. With a focus on helping individuals protect their retirement savings through diversification into precious metals, Augusta Precious Metals offers a range of products and services to assist investors in securing their financial futures.

In this review, we will delve into various aspects of Augusta Precious Metals, including the company’s background, products and services, customer experience, fees and pricing, security and trustworthiness, and customer support. By evaluating these factors, we aim to provide an in-depth analysis of Augusta Precious Metals’ capabilities as a precious metals dealer and IRA facilitator.

BEST FOR | PROS | CONS |

Individuals seeking protection against inflation through a hedge investment Investors aiming to enhance portfolio diversification by incorporating a precious metals IRA Those seeking a streamlined and straightforward IRA process Individuals dissatisfied with their current gold IRA company’s aggressive sales tactics Investors in search of a highly reputable and transparent gold IRA company, known for its compliance standards | Specializes in gold and silver IRAs Providesprehensive guides to assist consum

personalized guidance and dedicated account executives Partners with trusted IRA custodians and storage facilities Benefits include up to 10 years of covered fees on your behalf Ensures lifelong customer support for your account Recognized for its exceptional user ratings and accolades from ratings services | One notable drawback of Augusta Precious Metals’ gold IRA is that it requires a higher minimum investment amount of $50,000. While it may not be high for some individuals it might be high entry barrier for some . Physical location limited to Beverly Hills, California International shipping options may be limited |

If you’re uncertain about how to get started with opening a gold IRA account with Augusta Precious Metals we suggest downloading a complimentary guide on precious metals investments by filling this form with your name, email and phone.

This resource will provide you with comprehensive information to understand the advantages and disadvantages of investing in precious metals for your retirement portfolio. It serves as a valuable tool to help you make an informed decision.

Company Background

Augusta Precious Metals, established in 2012, is a reputable full-service precious metals dealer that provides a wide range of products and services to investors. They have gained recognition as one of the largest gold and silver dealers in the United States. Located at 8484 Wilshire Blvd #515, Beverly Hills, CA 90211, United States they hold an A+ rating with the Better Business Bureau, reflecting their commitment to customer satisfaction.

One way Augusta Precious Metals assists with retirement planning is by offering gold and silver IRA services. With a self-directed IRA, you retain complete control over your retirement account, allowing you to personally select the investments you wish to make. Gold and silver have been regarded as valuable assets and a form of currency for centuries. Today, they remain popular options for individuals seeking to diversify their retirement portfolios and safeguard against economic uncertainties. By utilizing Augusta Precious Metals’ services, you can explore the potential benefits of incorporating gold and silver investments into your retirement strategy.

* Gold and silver are physical assets that offer the advantage of easy storage and accessibility.

* They are not influenced by the fluctuations of the stock market or susceptible to government interference, providing a level of independence and stability.

Gold serves as a valuable long-term investment due to its independence from the performance of the stock market and other currencies.For centuries, the gold standard has provided stability, maintaining its value even during times of financial turmoil.

While gold prices may experience temporary fluctuations, they generally exhibit long-term stability, making it an attractive asset for individuals seeking to establish a secure and diversified retirement portfolio.

Augusta Precious Metals offers a self-directed individual retirement account (IRA) that allows investors to include physical gold and silver in their retirement savings.

The Internal Revenue Service (IRS) has approved specific coins and bullion bars for investment within an IRA, and Augusta Precious Metals provides a diverse selection of gold and silver products. A gold IRA can serve as a means to safeguard retirement savings against market volatility.

When opting for Augusta Precious Metals’ gold IRA, you have the opportunity to acquire gold bars or select from a range of IRA-approved gold coins, such as American Eagle (gold), American Eagle Proofs (gold), Canadian Maple Leaf (gold), Gold Canadian Eagle, American Buffalo (gold), and Australian Striped Marlin (gold).

Once your purchase is complete, you can choose a recommended certified storage facility to securely store your gold. Augusta Precious Metals facilitates free shipping of your gold to the custodian’s designated facility of your preference.

For those who prefer close proximity to their investment, you may opt to store your gold at a secure storage facility near you, enabling personal visits to observe your gold bars.

Augusta Silver IRA

A silver IRA is a self-directed retirement account that enables individuals to invest in physical silver bullion. It serves as a means of safeguarding retirement savings from market volatility, much like a gold IRA.

The Internal Revenue Service (IRS) has approved specific coins and bullion bars for inclusion in an IRA, and Augusta Precious Metals offers a diverse range of silver products.

Within a silver IRA, you have the option to purchase silver bars or select from a variety of IRA-approved silver coins, including Canadian Silver Soaring Eagle, Canadian Silver Eagle with Nest, American Silver Eagle, and Canadian Silver Maple Leaf.

For those who prefer to maintain proximity to their investment, you can choose a reputable storage facility near you to securely store your silver. This allows for personal visits to inspect and observe the silver bars.

IRA Custodians

An IRA custodian plays a crucial role in safeguarding and holding your retirement investments. They offer secure storage facilities for your gold and silver coins and bars.

Augusta Precious Metals, while not providing onsite storage, recommends the Delaware Depository as their preferred depository. The Delaware Depository is authorized by the IRC-408n and offers IRS-approved storage. It is also insured by Lloyds of London for up to $1 billion.

If the Delaware Depository doesn’t align with your preferences, Augusta Precious Metals can suggest alternative storage facilities in various locations, including Las Vegas, NV; New York, NY; Los Angeles, CA; Nampa, ID; Salt Lake City, UT; South Fargo, ND; and Shiner, TX. These facilities provide additional choices for securely storing your precious metals.

Augusta Precious Metals suggests the following custodians for your consideration:

1. Equity Trust: With over three decades of experience and serving clients across 50 states, Equity Trust is a trusted provider of self-directed IRAs. They have managed assets exceeding $25 billion, showcasing their expertise in the field.

2. GoldStar Trust Company: As a division of the Happy State Bank in Texas, GoldStar Trust Company oversees approximately 38,000 self-directed IRAs. They have earned an A+ rating from the Better Business Bureau (BBB), highlighting their commitment to customer satisfaction.

3. The Kingdom Trust: Established as the oldest and largest consumer-focused precious metals investment firm in the United States, The Kingdom Trust manages over $12 billion in assets. They have been a longstanding partner of Augusta Precious Metals, offering innovative custody solutions to more than 100,000 customers.

These suggested custodians provide reliable options for the safekeeping of your precious metals and come with notable experience and reputations in the industry.

Depository storage facilities, known for their high level of security, are strategically located far from political and financial centers. Augusta Precious Metals ensures that these licensed and reputable facilities are used, although they are separate entities from the company. These privately-owned facilities employ strict access controls and advanced security technologies.

If you prefer storing your precious metals at a different location for convenience, simply inform your account representative. Once confirmed, your precious metals will be delivered for safekeeping within 7 to 10 days.

Gold and Silver Cash Purchases

In addition to offering gold and silver products within an IRA account, Augusta Precious Metals also provides the option to purchase gold, silver coins, and bars for cash. These premium-quality products are available for both IRA and non-IRA investors.

You have the flexibility to store your acquired gold or silver in a personal vault at home, a bank, or utilize the suggested custodians recommended by Augusta Precious Metals.

Outside of an IRA, you have a wide range of gold and silver coins available for purchase. Some of the notable options include:

Gold Coins:

– 2022 St. Helena Gold Sovereign

– 2018 The Rose Crown Guinea

– American Gold Buffalo Proof

– Gold American Eagle Proof

– Certified American Eagle

– Certified American Buffalo

– $20 Saint Gaudens

– $10 Indian

– 2017 Great Britain ¼oz Gold Year of the Rooster

– 2016 Great Britain ¼oz Gold Year of the Monkey

– 2015 Canadian .25 Gold $10 Polar Bear and Cub

– 2014 Canadian .25% Gold $10 Arctic Fox

Silver Coins:

– American Silver Eagle 1oz BU (random year)

– Canadian Silver Maple Leaf

– Austrian Philharmonic Silver

– Silver Round 1oz – Our Choice Hallmark

– America the Beautiful

– Canadian Silver 5 Blessings

– Silver 50% Bag (various face values)

– Silver Bar

You can also find a variety of gold and silver bullion options:

– Gold Bullion: Gold American Eagle, Gold America Buffalo, Gold Canadian Maple Leaf, Austrian Gold Philharmonic, South African Gold Krugerrand, Gold Bar 10oz, and Gold Bar 1oz (Our Choice Hallmark)

– Silver Bullion: American Silver Eagle, Canadian Silver Maple Leaf, Austrian Philharmonic Silver, Silver Round 1oz, America the Beautiful (Cumberland Gap, Fort Moultrie, or Effigy Mounds), Canadian Silver 5 Blessings, Silver 90% Bag (in $100, $250, $500, $1,000), Silver Bar (10oz, 100oz) Our Choice Hallmark

It’s worth noting that collectible coins are certified by grading firms such as Numismatic Guaranty Corporation (NGC) and Professional Coin Grading Service (PCGS).

Augusta Gold and Silver Setup and Pricing

One-Time Setup Fees Example (Equity)

Custodian application fee $50

Annual custodian fee $100

Sample non-government depository storage fee $100

One-time setup fee total: $250

Recurring Annual Fees

Custodian maintenance fee $100

Non-government storage facility fee $100

Recurring annual fee total: $200

While there are fees associated with setting up an IRA account and purchasing gold or silver bars, the valuable support and free education provided by Augusta Precious Metals compensate for them.

Gold and silver have stood the test of time, consistently increasing in value over centuries. Remember that the value of your gold and silver is likely to appreciate over time, making it a wise investment. Augusta Precious Metals simplifies the process of investing in these precious metals, ensuring you don’t miss out on this valuable opportunity.

How to invest with Augusta Precious Metals?

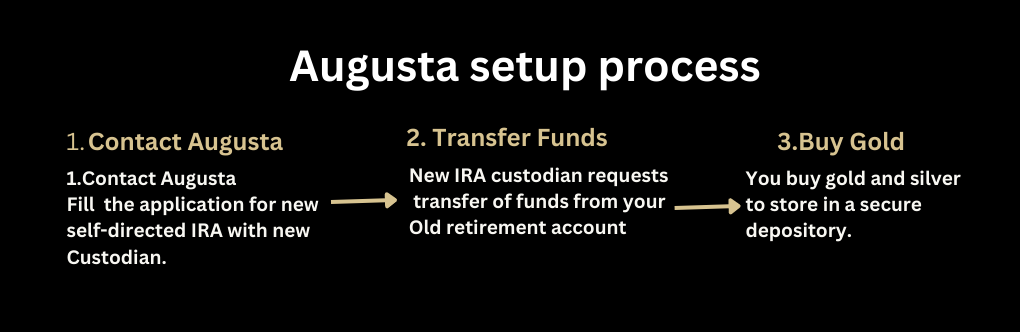

Investing with Augusta Precious Metals is a straightforward process. Here’s a step-by-step guide on how to get started:

1. Reach out to Augusta Precious Metals through their website or contact their customer service team. They will guide you through the investment process and answer any questions you may have.

2. Consultation and Portfolio Analysis: Schedule a consultation with an Augusta Precious Metals representative. They will assess your financial goals, risk tolerance, and investment preferences to develop a customized investment strategy.

3. You will be asked to fill out a form to open a new IRA account. This is very simple and only takes a few minutes.

4. Fund your account. Augusta Precious Metals will help you to move your funds from your existing IRA, Roth IRA, 401(k), 403(k), or other retirement accounts.

5. Once you have funded your account, you can start buying gold and silver. Augusta Precious Metals offers a wide variety of products, so you can find the perfect fit for your investment portfolio.

Support

At Augusta Precious Metals, every customer is assigned a dedicated personal account manager who will guide them through every step of the investment process.

Your account manager will assist you in opening an account, facilitating the funding process, and selecting the most suitable products for your portfolio. They will be there to address any questions or concerns you may have along the way.

With a dedicated account manager by your side, you can have peace of mind knowing that you have a knowledgeable and accessible point of contact throughout your investment journey with Augusta Precious Metals.

Conclusion

Augusta Precious Metals is a reputable provider of gold and silver IRA solutions, offering a range of products and services tailored to individuals seeking to diversify their retirement portfolios. With a focus on customer service, education, and transparency, Augusta Precious Metals aims to help customers protect and grow their wealth through strategic investments in precious metals.

While considering Augusta Precious Metals, individuals should conduct their own research and compare multiple companies to ensure they find the best fit for their investment needs. By carefully evaluating the pros and cons, individuals can make well-informed decisions and potentially benefit from the stability and growth potential offered by precious metals.